You can deduct 100% of the cost of your new gas

sterilizer from your 2024 gross income!

Purchase and begin using an

Andersen sterilizer before 12.31.2024

and write off 100% of the cost from your 2024 gross income!

Upgrade your existing Andersen Sterilizer to a new Andersen

sterilizer and receive an additional $500 trade-in-credit!

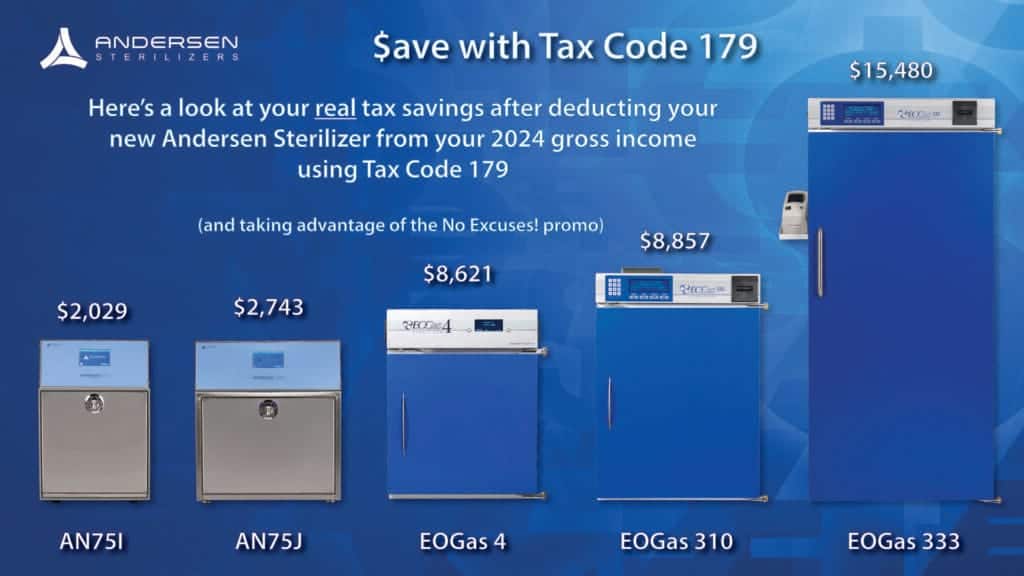

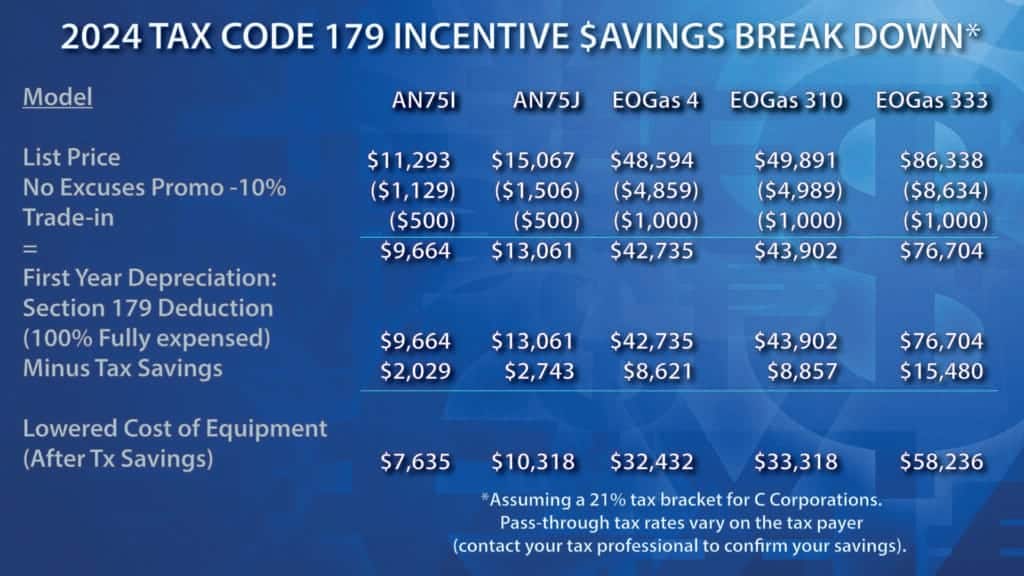

2024 Tax Code 179 Incentive Savings Break Down*

So what do I do next?

Contact your tax professional for full details on how to take advantage of this little-known small business powerhouse, contact us or read on to learn more about Tax Code 179.

Skip to: Tax Code 179 & Andersen Sterilizers, The Math, 100% Deduction, Which Purchases Qualify, Deduction Limit, Deadline, Equipment Spending Cap, 100% Bonus Depreciation

What is Tax Code 179, anyway?

IRS Tax Code Section 179 is an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves (text adapted from Section179.org).

It’s one of the few government incentives available to small businesses and has been included in many of the recent Stimulus Acts and Congressional Tax Bills. Although large businesses could also benefit from Section 179 or Bonus Depreciation, the original target of this legislation was much-needed tax relief for small businesses – and millions of small businesses are taking action and getting real benefits.

Many people think the Section 179 deduction is some mysterious or complicated tax code. It really isn’t. Here are six quick facts to keep in mind for 2023.

Speak to your tax professional about how to take full advantage of Tax Code 179.

100% Full Cost Deduction

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year.

If you buy a piece of qualifying equipment (including sterilizers and abators), you can deduct the FULL PURCHASE PRICE from your 2023 gross income.

In years past, when your business bought qualifying equipment, it typically wrote it off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example).

Now, while it’s true that this is better than no write-off at all, most business owners would prefer to write off the entire equipment purchase price for the year they buy it.

And that’s exactly what Section 179 does – it allows your business to write off the entire purchase price of qualifying equipment for the current tax year. This has made a big difference for many companies (and the economy in general). Businesses have used Section 179 to purchase needed equipment right now, instead of waiting.

Which Purchases Qualify?

Most tangible goods used by American small businesses, including “off-the-shelf” software and business-use vehicles (restrictions apply) qualify for the Section 179 Deduction.

Capital equipment – including Andersen sterilizers and abators – is a popular category that qualifies under Section 179.

The equipment purchased must be used for business purposes more than 50% of the time to qualify for the Section 179 Deduction.

Deduction Limit

Section 179 limits the total amount that can be written off – $1,160,000 for 2023.

All businesses need equipment on an ongoing basis, be it machinery, computers, software, office furniture, vehicles, or other tangible goods. It’s very likely that your business will purchase many of these goods during the year and will do so again and again. Section 179 is designed to make purchasing/leasing that equipment during this calendar year financially attractive.

Talk to your tax professional about the benefits of lowering your 2023 gross income by writing off the cost of your new Andersen sterilizer and other tangible business needs from 2023!

Deadline

To qualify for the Section 179 Deduction, the equipment and/or software purchased or financed must be placed into service between January 1, 2023 and December 31, 2023.

That means your Andersen sterilizer and/or abator must be up and running and benefiting your practice by year-end to qualify for a deduction.

Equipment Spending Cap

Section 179 limits to the total amount of the equipment purchased – $2,890,000 in 2022.

The deduction begins to phase out on a dollar-for-dollar basis after $2,890,000 is spent by a given business (thus, the entire deduction goes away once $4,050,000 in purchases is reached).

This makes it a true small and medium-sized business deduction.

80% Bonus Depreciation

Bonus depreciation is offered some years, and some years it isn’t. In 2023, it’s being offered at 80%. This year new and used equipment qualify for both the Section 179 Deduction (as long as the used equipment is “new to you”) and Bonus Depreciation.

Bonus Depreciation is useful to very large businesses spending more than the Section 179 Spending Cap (currently $2,890,000) on new capital equipment. Also, businesses with a net loss are still qualified to deduct some of the cost of new equipment and carry-forward the loss.

When applying these provisions, Section 179 is generally taken first, followed by Bonus Depreciation – unless the business had no taxable profit, because the unprofitable business is allowed to carry the loss forward to future years.

So what do I do next?

Contact your tax professional for full details on how to take advantage of this little-known small business powerhouse. Or contact us!